Calculate diminishing value depreciation

Find the depreciation rate for a business asset. 80000 365 365 200 5 32000 For subsequent years the base value will reduce based on the difference between the current year and the next year.

Depreciation Formula Examples With Excel Template

An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

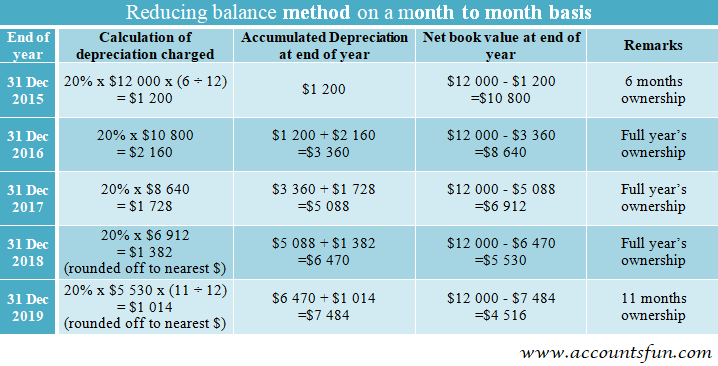

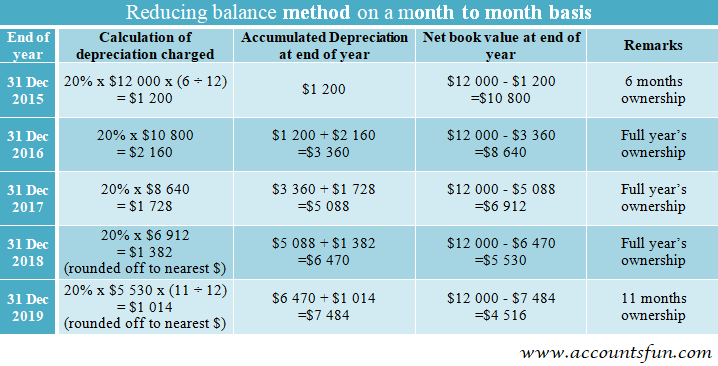

. View the calculation of any gain or loss on sale on the disposal of an asset when appropriate. This would be applicable for both Straight Line and Diminishing Value depreciation. The diminishing balance method also known as the reducing balance method is a method of calculating depreciation at a certain percentage each year on the balance of the asset which is brought from the previous year.

Carpet has a 10-year effective life and you could calculate the diminishing value depreciation as follows. Depreciation amount opening balance depreciation rate. Ad Life Is For Living.

Option 3 - 8995 - Same report as in option 2 above plus instructions sample claim demand letter negotiating tips. Step one - Calculate the depreciation charge by using below given formula Depreciation charge per year Asset value - Residual value x Depreciation percentage 3000 - 1000 x 15 300 Step two - Subtract depreciation charge from current asset value to get the remaining balance Balance 3000 - 300 2700. Depreciation rate finder and calculator.

Ad Diminished Value Diminished Value Insurance Company Diminished Value Claim. Year 1 2000 x 20 400 Year 2 2000 400 1600 x 20 320 Year 3 2000 400 320 1280 x 20 256 And so on and so on. In this example the base value for the second year will be 80000 32000 48000.

For example 2 is 200 and commonly called double declining depreciation. Cost value 10000 DV rate 30 3000 depreciation to claim in your tax return The remaining 7000 is the espresso machines adjusted tax value to use in next years return. Base Loss of Value which is calculated at 10 of the current Kelley Blue Book value X Damage Modifier X Mileage Modifier Diminished Value.

The 17c formula is as follows. Use the diminishing balance depreciation method to calculate depreciation expenses. Option 2 - 6995 - Professionally formatted printable report for submission to the responsible party.

Ad Insurance Total Loss Dispute Settlement - Diminished Value Claims. Find A Dedicated Financial Advisor. Depreciation - 10500 calculated from 1306 300606 - But only 4 months in this tax year.

Placed in Service select the month and enter the year the asset started being used for its intended purpose Year. Use a depreciation factor of two when doing calculations for double declining balance depreciation. Depreciation amount 1750000 12 210000 closing balance 1750000 210000 1540000.

For example the diminishing value depreciation rate for an asset expected to last four years is 375. Lets Partner Through All Of It. You calculate it by deducting the total depreciation from the purchase cost of the asset.

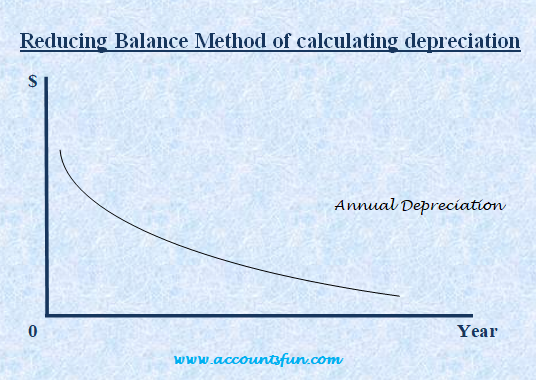

Depreciation per year Book value Depreciation rate Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice the value of straight line depreciation for the first year. Depreciation - 26250 - 12 months in this tax year 300607 Depreciation 13125 - 12 months in this tax year 300608. Base value days held 365 150 assets effective life Reduction for non-taxable use.

If you paid 10000 for a commercial espresso machine with a diminishing value rate of 30 work out the first years depreciation like this. Similarly Depreciation amount and closing balances are calculate for respective years. Another common method of depreciation is the diminishing value method.

Calculate depreciation for a business asset using either the diminishing value DV or straight line SL method. Pre-purchase Inspection - Free Consultation -Available Weekends - Call Now. It is calculated by dividing 200 by an assets useful life in years 150 if the asset was held before 10 May 2006.

Rather depreciation is recalculated each year based on the assets depreciated value or book value. Net Book Value is the assets value at the start of each year. If you started to hold the asset before 10 May 2006 the formula for the diminishing value method is.

Net Book Value USD 105000 first year equal to the cost of the car Residual value USD 5000. Option 1 - 1995 - Basic on-screen indication of the diminished value your vehicle has incurred. Closing balance opening balance depreciation amount.

Insurance Companies How To Calculate Diminished Value more. You can use this tool to. The depreciation rate is 60 Well here is the formula Depreciation Expenses Net Book Value Residual value X Depreciation Rate Here is the value of each element.

This is best illustrated in an example. Remember our car from Johns Car Shop. Ledger for above statements.

When using this method assets do not depreciate by an equal amount each year. This factor is used to calculate the depreciation rate per year. Salvage Value is how much you can sell the asset for at the end of its useful life.

Calculate Diminishing Value Depreciation First Year diminishing value claim calculation. Annual depreciation Net Book Value - Salvage Value x percentage rate Where. It is important to check with the ATO about prescribed depreciation rates and the accepted useful lifetime of different.

Depreciation Formula Calculate Depreciation Expense

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Fixed Asset Cash Flow Statement

Depreciation Diminishing Value Method Youtube

Depreciation Formula Examples With Excel Template

Depreciation Rate Formula Examples How To Calculate

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Accumulated Depreciation Definition Formula Calculation

Depreciation Methods Principlesofaccounting Com

How To Calculate Depreciation Youtube

Depreciation Formula Examples With Excel Template

Depreciation Calculator Depreciation Of An Asset Car Property

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It

Methods Of Calculating Depreciation Accounting Simpler Enjoy It Method Calculator Accounting

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It